Trump's Economic Policies and Effects on the World, Especially China and Russia

Aggressive Tariffs, Sanctions, and Global Repercussions

Introduction

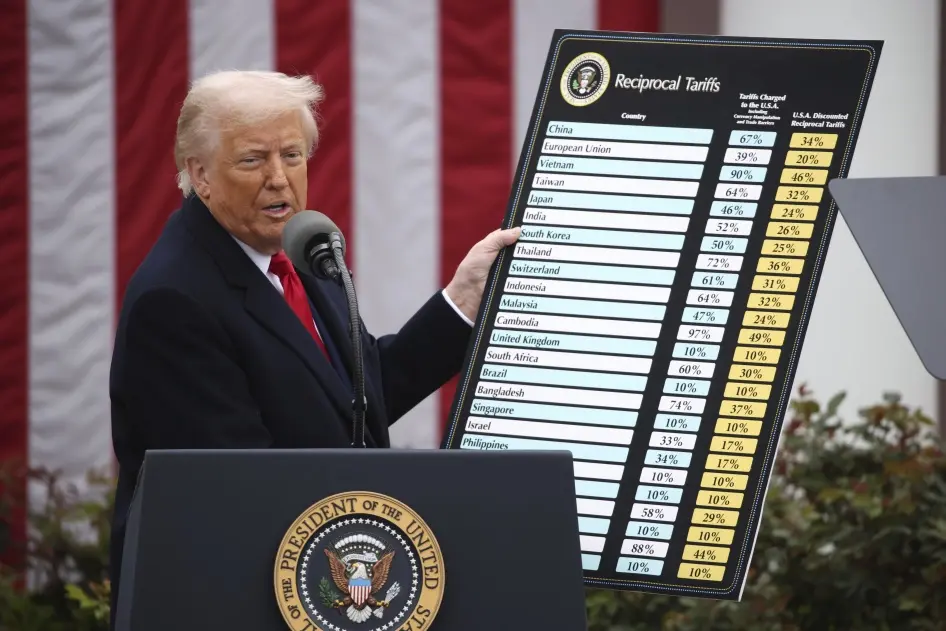

President Donald Trump's economic policies in his second term (2025) are characterized by aggressive tariffs, sanctions, and a focus on "America First" priorities. Key moves include tariffs up to 500% on countries buying Russian oil (targeting India, China, and Brazil), seizing Venezuela's oil reserves (giving the U.S. nearly 30% of global oil reserves), and withdrawing from 66 international treaties, including the Paris Agreement. These policies aim to boost U.S. manufacturing and reduce dependence on adversaries like China and Russia, but they risk global recession, inflation, and trade wars.[1][2]

Key Economic Policies

- Tariffs on Russian Oil Buyers: Up to 500% tariffs on countries like India, China, and Brazil to pressure Russia economically.

- Seizure of Venezuela's Oil Reserves: U.S. control over nearly 30% of global oil reserves strengthens its position as a price-setter.

- Withdrawal from International Treaties: 66 treaties, including Paris Agreement, weakening global cooperation.

- Future Reforms: Higher prevailing wages for H-1B visas and merit-based lottery to prioritize high-skill workers.

These policies could boost U.S. manufacturing but risk global recession and inflation.[3]

Effects on China

China faces significant pressure from Trump's policies:

- Sanctions on Russian Oil: Potential 500% tariffs if China continues buying Russian oil, under the Sanctioning Russia Act.

- Rare Earth Exports: Trump threatened 100-200% tariffs if China restricts rare earth exports, vital for U.S. tech.

- Trade Tensions: China retaliates with tariffs on U.S. goods and export controls on rare earths, shifting trade to Yuan.

- Economic Impact: China's "electro-state" economy (AI, EVs) grows, but tariffs and sanctions could slow growth and disrupt supply chains.[4]

Effects on Russia

Russia's economy is heavily impacted:

- Oil Sanctions: Tariffs on buyers like China and India reduce Russia's revenue from oil exports.

- New START Treaty: Expires February 2026; Trump is undecided on extension, wanting China included.

- Geopolitical Leverage: Trump aims to improve U.S.-Russia relations to pressure China, but Putin prioritizes ties with Beijing for economic support and political cover.

- Economic Impact: Sanctions and tariffs exacerbate Russia's isolation, though Chinese largesse provides some buffer.[5]

Global Impact

Trump's policies have broader global repercussions:

- Trade Wars: Tariffs disrupt global supply chains, boosting U.S. manufacturing but risking recession and inflation.

- Geopolitics: U.S. withdrawal from treaties weakens cooperation; emerging markets benefit from lower oil prices but face volatility.

- Europe: Concerned about cheap Chinese imports, considering countermeasures.

- Eurasia Group Warning: Trump's policies make him the top global risk, as the U.S. slips behind China's "electro-state" economy.[6]

- Central Asia: Becomes a battleground, with Trump meeting leaders to counter China-Russia influence.[7]

Uncertainty and Future Outlook

The Supreme Court's decision on Trump's tariffs (expected early 2026) could change everything. Alliances may hold, or nations could hedge against U.S. unpredictability. Trump's "reverse Nixon strategy" aims to leverage Russia against China, but durable Sino-Russian ties complicate this.[5]

Conclusion

Trump's economic policies—tariffs, sanctions, and treaty withdrawals—are reshaping global trade, geopolitics, and economies. China and Russia face significant pressure, with tariffs threatening oil trade and rare earth supplies, while the U.S. aims to reduce dependence on adversaries. Global risks include recession, inflation, and fractured alliances. The Supreme Court ruling and international responses will determine long-term effects. Monitor White House briefings (https://www.whitehouse.gov) for updates.[1][2]